"CAR_IS_MI" (car-is-mi)

"CAR_IS_MI" (car-is-mi)

04/14/2014 at 15:05 • Filed to: None

1

1

24

24

"CAR_IS_MI" (car-is-mi)

"CAR_IS_MI" (car-is-mi)

04/14/2014 at 15:05 • Filed to: None |  1 1

|  24 24 |

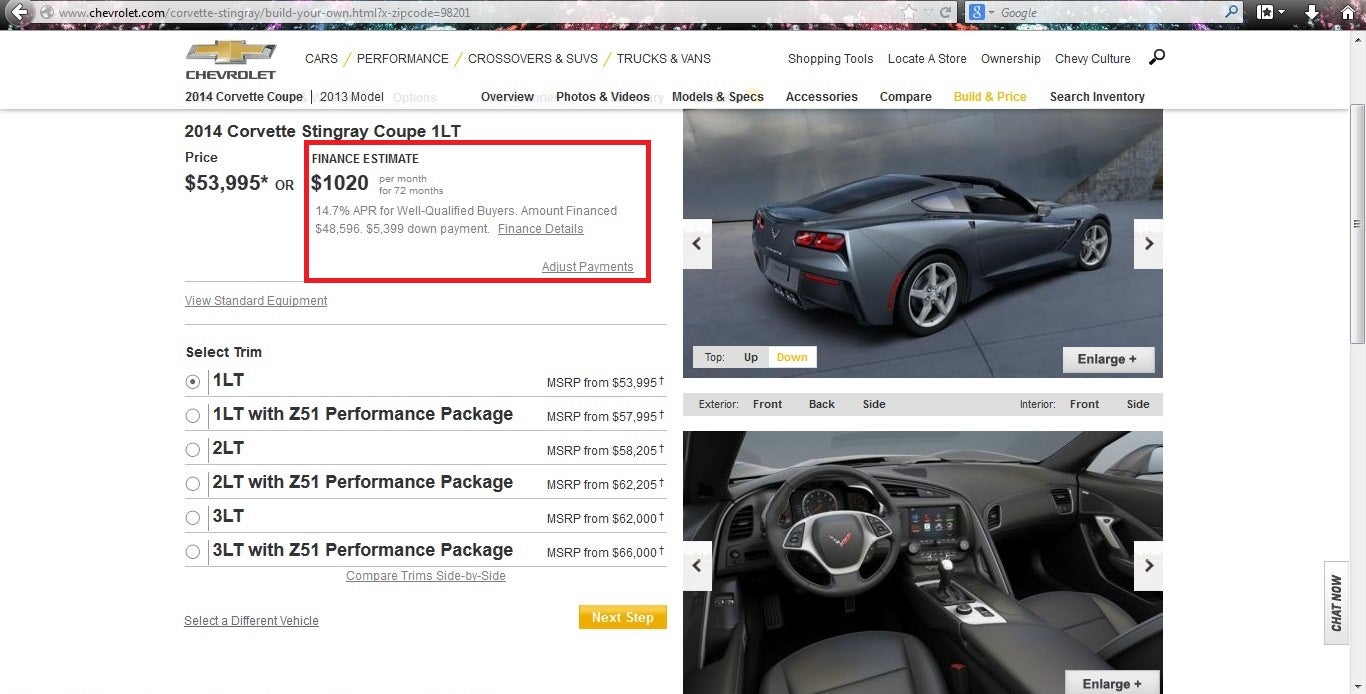

Doing what I do all day.. building cars I can't own, I decided to build a Vette that I 'could' afford if I were to trade in everything else (not pictured above). Well for once I paid attention to the price thing and I saw this:

14.7% APR for Well-Qualified Buyers. Amount Financed $55,971. $6,219 down payment.

Really? 14.7% ? That's the 'well qualified' APR? Of the past 3 vehicle I have purchased off the lots, 2 had price tags over $50k and one could be considered a performance vehicle. None of them had an APR over 4%. 14.7% Chevy? ARE YOU FUCKING HIGH?

ddavidn

> CAR_IS_MI

ddavidn

> CAR_IS_MI

04/14/2014 at 15:07 |

|

Yeesh, that's a lot of APR.

CAR_IS_MI

> ddavidn

CAR_IS_MI

> ddavidn

04/14/2014 at 15:08 |

|

Seriously, I could take out a second mortgage on my house and make out better.

RamblinRover Luxury-Yacht

> CAR_IS_MI

RamblinRover Luxury-Yacht

> CAR_IS_MI

04/14/2014 at 15:10 |

|

APRs: many. Many APRs.

ddavidn

> CAR_IS_MI

ddavidn

> CAR_IS_MI

04/14/2014 at 15:10 |

|

Or maybe talk to AMEX about that Black card.

For Sweden

> CAR_IS_MI

For Sweden

> CAR_IS_MI

04/14/2014 at 15:13 |

|

Link?

Dukie - Jalopnik Emergency Management Asshole

> For Sweden

Dukie - Jalopnik Emergency Management Asshole

> For Sweden

04/14/2014 at 15:16 |

|

I screenshotted this. Holy shit!

CAR_IS_MI

> ddavidn

CAR_IS_MI

> ddavidn

04/14/2014 at 15:19 |

|

We had that conversation, to be considered for a black card I need to spend an average of something stupid like $200,000 / mo. I'm only about $198,000 short.

CAR_IS_MI

> For Sweden

CAR_IS_MI

> For Sweden

04/14/2014 at 15:20 |

|

Chevrolet.com ...

ddavidn

> CAR_IS_MI

ddavidn

> CAR_IS_MI

04/14/2014 at 15:21 |

|

I thought they only had a limit of like $250,000 or half a million or some amount of money I can't imagine having. I know I'm not eligible because they canceled my business credit card when I put a thousand bucks on it....

CAR_IS_MI

> ddavidn

CAR_IS_MI

> ddavidn

04/14/2014 at 15:23 |

|

Maybe that was for the black for business card I was thinking of, but yea, its exorbitant.

Brian Silvestro

> CAR_IS_MI

Brian Silvestro

> CAR_IS_MI

04/14/2014 at 15:23 |

|

They must be finding stupid old people that'll agree to this

CAR_IS_MI

> Brian Silvestro

CAR_IS_MI

> Brian Silvestro

04/14/2014 at 15:24 |

|

I mean I know they got to pay for those recalls somehow, but I feel like I could get a better rate from a credit union using an old shoelace as my only form of credit history...

Brian Silvestro

> CAR_IS_MI

Brian Silvestro

> CAR_IS_MI

04/14/2014 at 15:27 |

|

I'm 19 and I can get a better loan on a house than this.

ddavidn

> CAR_IS_MI

ddavidn

> CAR_IS_MI

04/14/2014 at 15:28 |

|

Crazy. My old boss bought a Z4 on a credit card once, because nobody would give him an interest rate that good.

CAR_IS_MI

> ddavidn

CAR_IS_MI

> ddavidn

04/14/2014 at 15:29 |

|

My roommate bought a motorcycle on a credit card with a flex interest rate because no one would give him a loan... the interest rate WAS 6% it has gone up to like 24% in the past 10 months... Granted, I think the black card has a fixed rate.

MontegoMan562 is a Capri RS Owner

> CAR_IS_MI

MontegoMan562 is a Capri RS Owner

> CAR_IS_MI

04/14/2014 at 15:30 |

|

holy hell. this is why i bring my own financing!

CAR_IS_MI

> MontegoMan562 is a Capri RS Owner

CAR_IS_MI

> MontegoMan562 is a Capri RS Owner

04/14/2014 at 15:33 |

|

The only time I have seen that high of a rate is for high risk purchasers. this says "Well Qualified". I would hate to see what high risk rates are ( I think gov regulated max is 29% so I am assuming 29%).

ddavidn

> CAR_IS_MI

ddavidn

> CAR_IS_MI

04/14/2014 at 15:34 |

|

Now THAT is a lot of interest... My cards average 24% which is why I wouldn't put a car on them.

CAR_IS_MI

> ddavidn

CAR_IS_MI

> ddavidn

04/14/2014 at 15:35 |

|

I try to not leave anything on a card unless it has a 0% offer.

ddavidn

> CAR_IS_MI

ddavidn

> CAR_IS_MI

04/14/2014 at 15:38 |

|

I had that thought as well. Too bad I drowned myself in debt instead. Damn freelancing. I'll run my own business, I said... it'll be fun, I said...

CAR_IS_MI

> ddavidn

CAR_IS_MI

> ddavidn

04/14/2014 at 15:41 |

|

I too am about to do the same with a startup planned in the next 6 - 8 months. I greatly look forward to being broke as fuck and making minimum payments on maxed out cards...

ddavidn

> CAR_IS_MI

ddavidn

> CAR_IS_MI

04/14/2014 at 15:44 |

|

That's exactly what happened to me. It was fun for the whole year, though. If I had started with any money saved up, or gotten half the projects I was promised, I would've come out way ahead. Or if I had been single.

CAR_IS_MI

> ddavidn

CAR_IS_MI

> ddavidn

04/14/2014 at 15:47 |

|

Ahh, So I am ahead of the curve then... (have some $ saved and am single)

ddavidn

> CAR_IS_MI

ddavidn

> CAR_IS_MI

04/14/2014 at 16:19 |

|

Nice. When you're single, you can make a lot of things work temporarily. When you're married, you find expenses hard to cut back on. I do, anyway. I would've been happy running my business out of an apartment with 3 roommates if I had to. Or my car. Oh well, there'll be time to run my own business when I'm retired.